Financial Literacy and Why It Matters

I know when I was a freshman here at UMD, it was hard to fathom that I was beginning my adulthood and part of that was managing my money!

It often made me anxious to think about having to navigate making choices about my spending, saving, and credit (*gasp*). These things may also make you a bit anxious and that is ok! However, there is nothing to be afraid about! Making smart money moves is all about making informed money moves. You’ll take the fear out of dealing with your money by figuring out exactly what you are getting yourself into, which is exactly what this post is for!

This DSAC Digest post will give you some information about how to go about budgeting, credit, loans, as well as giving you some on-campus resources you can utilized to start your money-savvy journey!

Budgeting and Saving

How to Guide to Being Money Savvy

If you are just starting to consider how you can handle your money better, one of the best things you can do first is journaling/writing out your income and general expenses. In doing so, you will be able to see how much money is coming in and going out, then you can start planning what you need to put more money towards and what you can cut spending on.

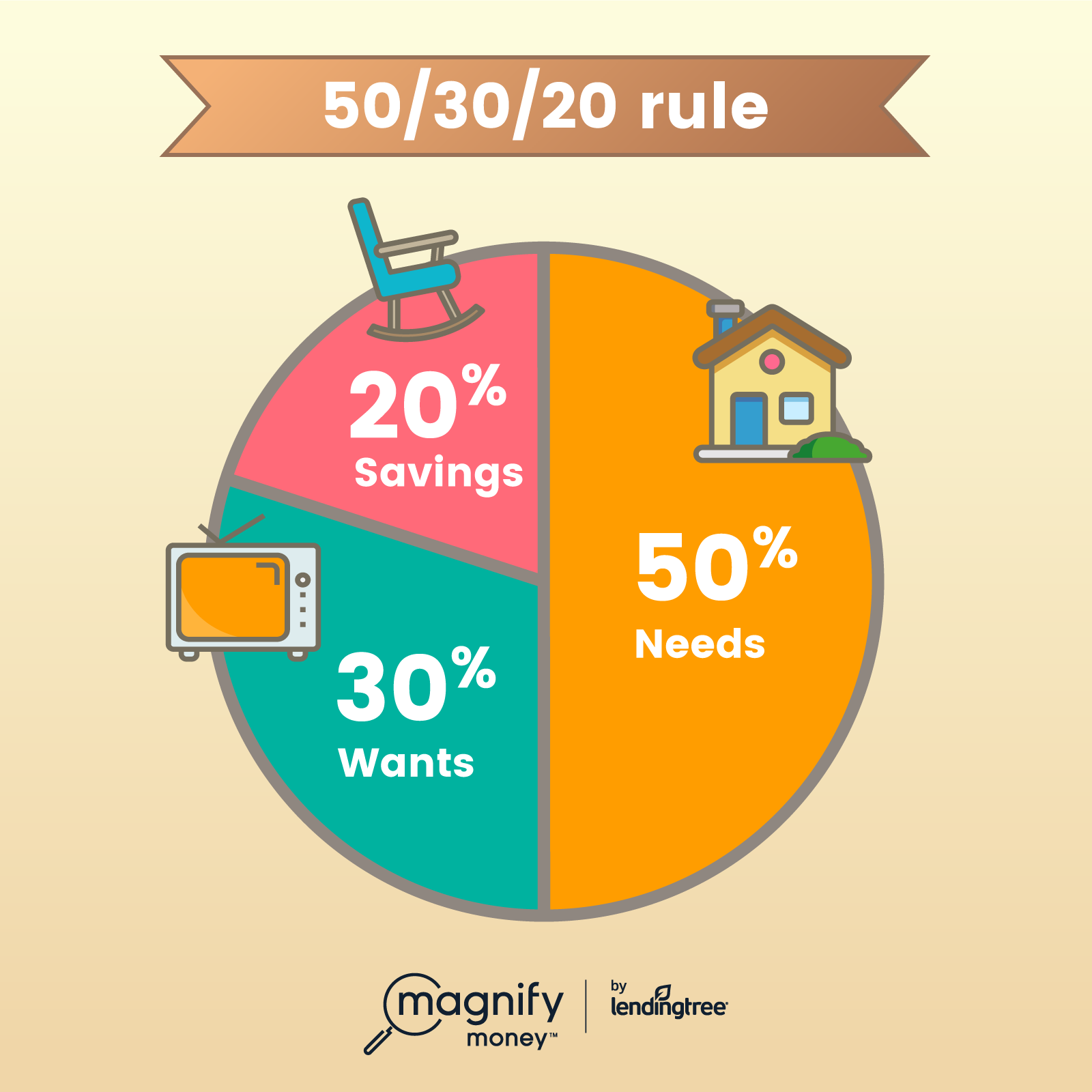

There are many methods possible on how to portion your paychecks. Read about the 50/30/20 Rule below!

The 50/30/20 Rule

The 50/30/20 Rule is a budgeting strategy that divides your income into three categories and allocating money to these categories as follows: needs (50%), wants (30%), and savings (20%). Your ‘needs’ category covers important expenses like rent, credit card/phone/utility bills, car notes, and more. Your ‘wants’ category covers expenses that are not necessarily things you need to have but like having in your day-to-day life like streaming subscriptions, hobbies, vacations, and other things. Your ‘savings’ category is simply money set aside for rainy days or emergencies.

Want to see what budgeting you paycheck would look like with the 50/30/20 Rule? Click the button below to access a 50/30/20 calculator, which allows you to put in your income after-taxes and see how much will be allocated to each category!

3 Free Apps for Budgeting and Savings

Goodbudget

“A home budget app based on the envelope budget system.” – Goodbudget.

Available for free on App Store and Google Play.

NerdWallet

“Track your budget and credit score on the NerdWallet app, and let the Nerds guide you toward your financial goals.” – Nerdwallet

Available for free on App Store and Google Play.

Buddy

“Say hello to your new financial companion, bringing you financial peace of mind today.” – Buddy

Available for free on App Store.

Feel free to find more apps perusing the App Store/Google Play Store! There are so many out there; find the right one for you!

Navigating Your Student Loans

Thinking Ahead on Student Debt

For many students, loans can be a vital piece for financing their education. Loans are great but, they must be paid back at some point! It is never too early to start planning how you will go about paying your student loans! Here is a general timeline for your consideration!

Before Taking Out Loans…

- Make sure you have taken advantage of all “free money” (i.e. scholarships, grants)

- Know which type of loans you want to take out

- Subsidized – you will not be charged interest while enrolled in school or during your six-month grace period

- Unsubsidized – interest starts accumulating as soon as you receive loans from your school

- To learn more, click here.

While in School…

- Feel free to keep track of your loans, find out who your loan distributor is, etc. on the Federal Student Aid website!

After Graduating…

- Start strategizing your repayment

- Know your grace period. This is how much time you have before you are required to make payments on your loans. The typicall grace periods is 6-months after graduation.

- Learn about repayment plans and choose one that is right for you, your income, and the amount of loans you have.

- Start strategizing your repayment

Please be advised these are just general tips; you know what is best for you! Always try to make financial decisions based on your own knowledge of your financial situation and goals!

Navigating Credit

Credit Cards Decoded

Credit cards are cards in which companies allow you to borrow a certain amount of money with the expectation that you will repay them later. There are many things you should keep in mind when deciding to get a credit card and not knowing these things can mess you up in the long run. Read about some general information about credit cards below!

Before Choosing a Credit Card…

Think about why you want a credit card – Don’t think of credit cards as “free money” because the money you spent is not technically yours!

Consider how well you currently manage your money – Because you have an obligation to repay the money you spend, you should think about if you can truly handle that task based on how good you are at managing your debit card (if you have one).

When Choosing a Credit Card…

Look out for cards with no annual fees – An annual fee is a charge billed to you by some credit card companies for having a card with them. These fees can range from $50 to $500 so, be mindful!

Look out for cards with cash-back programs, rewards, etc. – Some credit card companies may have special rewards or offer cash back to use on your balance for using your credit card at certain establishments. This could be a plus for whatever card you choose!

Look out for credit card companies that have student cards – Companies like Discover and Mastercard offer cards specifically for college students that include special benefits like little to no interest rates, no annual fees, and more. Try to seek these out!

When Having a Credit Card…

Avoid making late payments – Late payments are a bad look to credit card companies. This can especially give you a bad reputation if you seek to buy a car, house, etc, as your credit score can take a significant hit. Try to make payments little by little throughout each month, if you can.

Be mindful of your credit limit – A credit limit is the maximum amount of money the credit card company has allotted for you to spend. Going over your limit can result in fees, a hit to your credit score, and more. You can check your credit limit with your credit card company’s app (or even request an increase in your credit limit if you need it).

Please be advised these are just general tips; you know what is best for you! Always try to make financial decisions based on your own knowledge of your financial situation and goals!

Smart Spending/Saving: Where to Start

Money-Saving Resources for College Students

I never like to call myself broke. Instead, I am balling on a budget! One of the perks of being a college student is the amount of money-saving opportunities available; you just have to find them! In the slideshow below are a few things you can do/use to save a few bucks.

UMD Courses About Financial Literacy/Wellness

Hopefully this blog post has interested you enough to start thinking seriously about your finances. UMD offers quite a few courses that you could take to explore this a bit more!

FMSC341

Personal and Family Finance

- 3 Credits

- No Restrictions

- Fulfills Distributive Studies – Scholarship in Practice (DSSP) GenEd

UNIV362

Designing Your Life after College

- 2 Credits

- Restriction: Must have earned at least 60 credits

- Does not fill any GenEds

BMGT298J

Special Topics in Business and Management; Personal Financial Success During College

- 1 Credit

- No Restrictions

- Does not fill any GenEds

BMGT298K

Special Topics in Business and Management; Personal Financial Success After College

- 1 Credit

- No Restrictions

- Does not fill any GenEds

If you are experiencing a financial emergency…

UMD has several resources you can use to support you. Please refer to the buttons below for resources that could possibly be of assistance to you.

What’s Up With DSAC?

The BSOS Dean’s Student Advisory Council always has some amazing events planned each month so, what’s happening this month? Take a peek below!

April

Maryland Day 2025

Location: UMD Campus | Date: Saturday, April 26th | Time: 10:00 A.M. to 4:00 P.M.

DSAC will be joining the University in celebrating Maryland Day on Saturday, April 26th, 2025. Make sure to stop by our table for some fun games and prizes!

DSAC’s location at Maryland Day will be updated via Instagram.